How to automate your mileage log book

Keeping a log book has never been easier. Automatically track your miles and quickly create and share your log book for reimbursement or HMRC deductions.

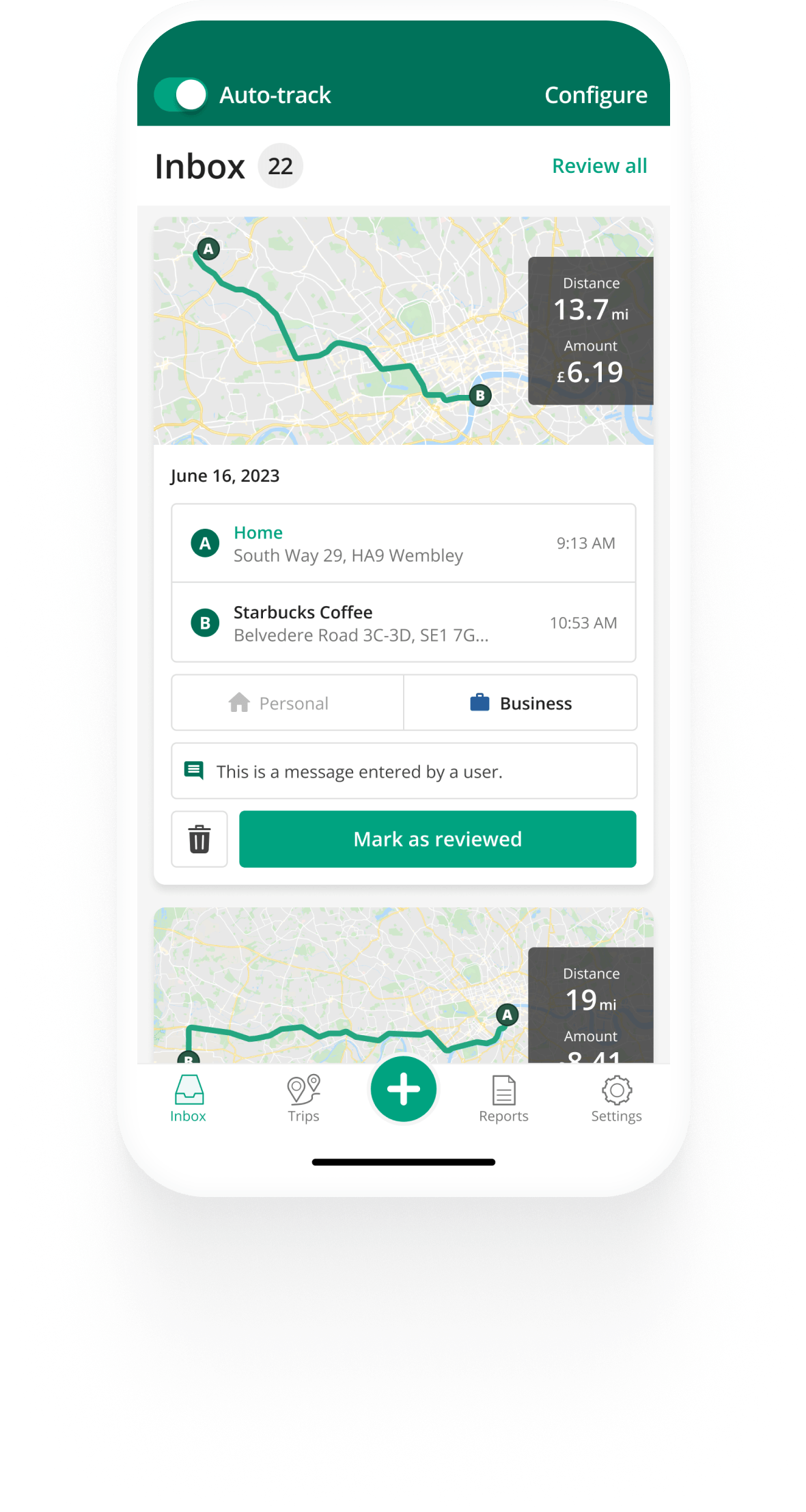

How to automatically track mileage

Mileage tracking made easy

Use the Driversnote mileage log book app to track trips automatically - no need to even open the app. We will log all the required information for you and calculate your reimbursement. You can always add or edit trip details later on.

Read more Sign upIntelligent classification of your trips

Business or Personal?

Make sure you’re HMRC compliant by logging your mileage under the correct category. Review and classify your trips as Business or Private in a simple overview. Add your working hours to the app and we will even classify your trips automatically.

Read more Sign upWhat our customers say about us

easy to use

Great app for mileage tracking and cost

such an easy app to use, love the reports generated each month, keeps me on top of what kms are going to personal and business trips. makes claiming petrol at eofy so easy!

Great service I emailed quite a grumpy email stating a fact and Dominique emailed back explaining how I was wrong (she was correct) and she did it very nicely and also offered to make it right - even though I was wrong. I just felt that was amazing service.

dummy proof

works well so you don't have to!!

Great service I emailed quite a grumpy email stating a fact and Dominique emailed back explaining how I was wrong (she was correct) and she did it very nicely and also offered to make it right - even though I was wrong. I just felt that was amazing service.

dummy proof

works well so you don't have to!!

Easy to use.

Great app! Super easy to use. Thank you.

wow

Easy to use.

Great app! Super easy to use. Thank you.

wow

Frequently Asked Questions

You typically need to provide your employer with a mileage log of your business travel, along with receipts for any expenses related to the travel such as parking, or tolls. Your employer may also require you to complete a claim form or submit a written request for reimbursement.

Calculate your reimbursement by multiplying your business mileage by the current year’s HMRC-approved rate, or the rate you are reimbursed at. For example, if you’ve driven 4000 business miles this year, and use the HMRC mileage rate (45 pence for the first 10,000mi) the calculation will be the following:

4000 mi x 45 pence = £1800 in mileage reimbursement.

The best way to record mileage for tax purposes in the UK is to keep a detailed mileage log that includes the date, purpose, and distance of each business journey. There are a variety of tools available to help you keep track of your mileage, and we recommend using a mileage tracker app such as Driversnote. It's important to keep accurate records, as you may be required to provide evidence of your business travel if you are audited by HMRC.

Get started for free

Never miss a trip

We've got you covered, and it's easy to get started, and even easier to keep going.