Mileage tracking made easy

Easy and automated trip logging. Accurate and HMRC compliant mileage logs. All you need is your phone, and you’re good to go.

Trusted by millions of users

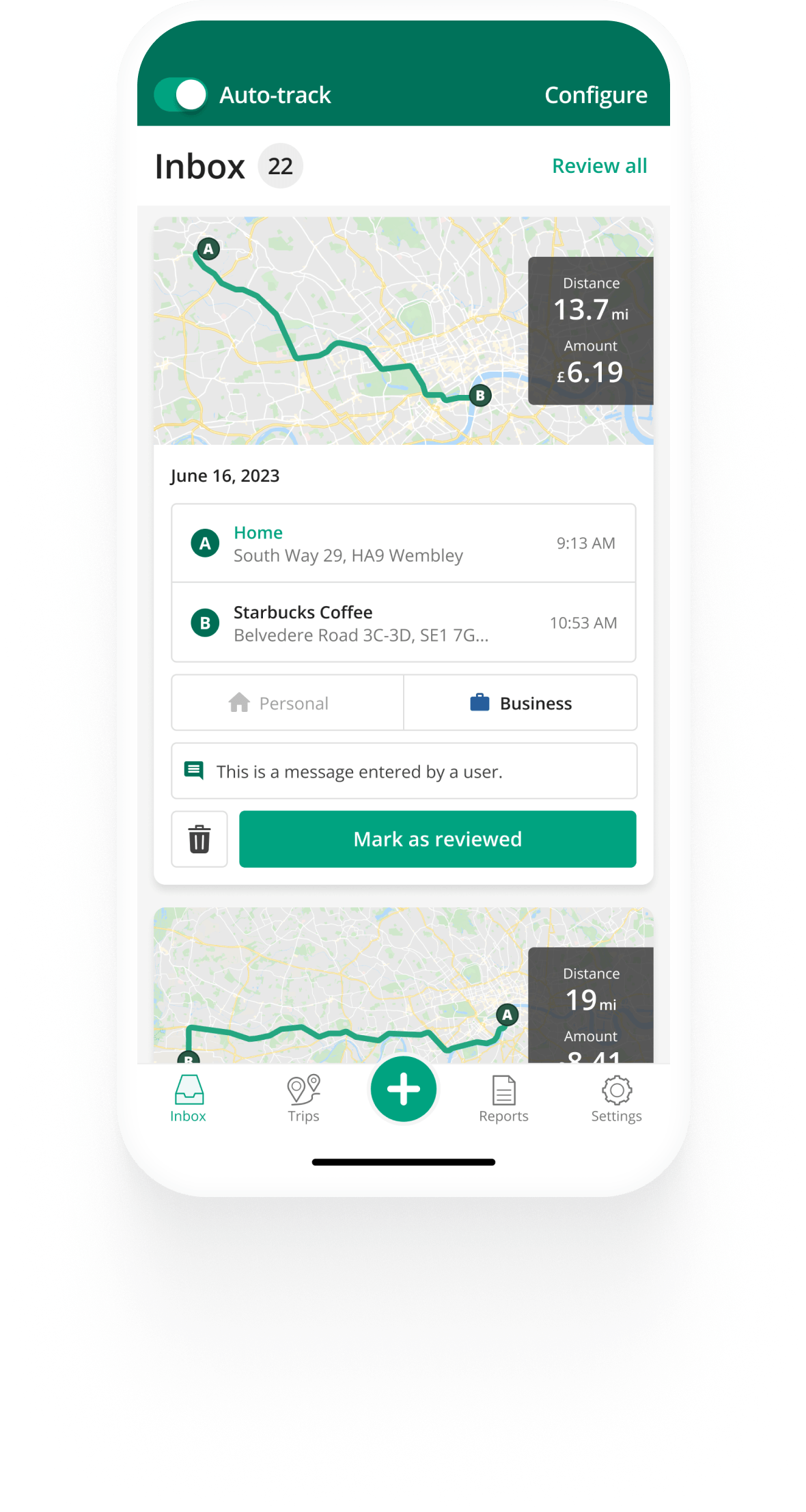

Auto-track

Track trips from your pocket

With Driversnote as your automatic mileage tracker, you can record trips without even opening the app. The motion detector lets you auto-track trips - all you have to do is drive. And if you forget to track, you can easily create manual trips later.

Read more Sign upWhat our customers say about us

easy to use

Great app for mileage tracking and cost

such an easy app to use, love the reports generated each month, keeps me on top of what kms are going to personal and business trips. makes claiming petrol at eofy so easy!

Great service I emailed quite a grumpy email stating a fact and Dominique emailed back explaining how I was wrong (she was correct) and she did it very nicely and also offered to make it right - even though I was wrong. I just felt that was amazing service.

dummy proof

works well so you don't have to!!

Great service I emailed quite a grumpy email stating a fact and Dominique emailed back explaining how I was wrong (she was correct) and she did it very nicely and also offered to make it right - even though I was wrong. I just felt that was amazing service.

dummy proof

works well so you don't have to!!

Easy to use.

Great app! Super easy to use. Thank you.

wow

Easy to use.

Great app! Super easy to use. Thank you.

wow

The features that make mileage tracking less of a pain

Create locations

Track your trips faster by saving frequently visited places.

Multiple vehicles

Track mileage and keep separate logs for multiple vehicles.

Multiple Workplaces

Track mileage and keep separate logs for multiple workplaces.

Work Hours

Set your work hours and let the app categorise your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

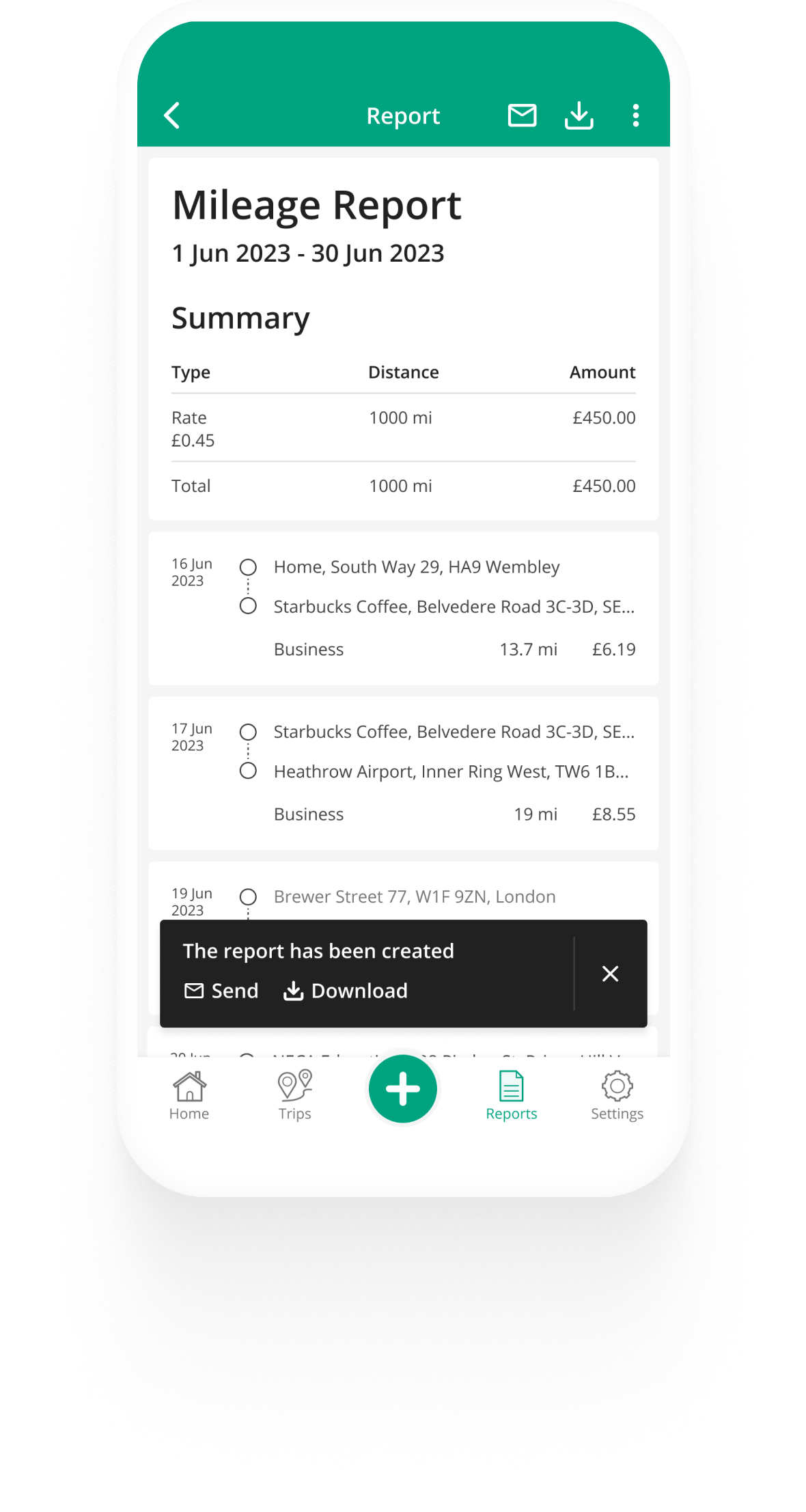

Custom Mileage Rates

Customise your mileage log with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Work Hours

Set your work hours and let the app categorise your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

Custom Mileage Rates

Customise your mileage log with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Get started for free

Never miss a trip

We've got you covered, and it's easy to get started, and even easier to keep going.

Top posts

HMRC mileage guide

Latest update: 6 March 2026 - 5 min read

Welcome to our guide on mileage claims and reimbursement in the UK. This guide will walk you through the rules that apply to your situation.

How to pick the best mileage tracker app

Latest update: 19 February 2026 - 2 min read

Maintaining consistent and accurate records of trips without a mileage tracker app can be a chore. Here's how an app can make things easier.

HMRC mileage log requirements

Latest update: 14 June 2024 - 2 min read

If you want to receive a mileage allowance, keeping a log book will be necessary. Here are things you must record to make your logs accurate and compliant.

Frequently Asked Questions

Yes, you can use a mileage tracker to claim tax relief in the UK if you use your personal vehicle for business purposes. To claim tax relief for your mileage, you'll need to keep accurate records of your business mileage, which can be done using a mileage tracker.

A mileage tracker works by using GPS technology to track the distance you've travelled in your vehicle. Some apps also allow you to manually enter your mileage. GPS-tracked trips are reliable and fully automatic, saving you time tracking mileage with pen and paper.

Some mileage trackers can log mileage for multiple vehicles. This feature will come in handy if you use more than one vehicle for work-related purposes and need to submit separate logs of your driving for different types of reimbursement. With Driversnote, you can track mileage for multiple vehicles - be it cars, vans, motorcycles or bicycles.